PPP Policy, Legal, and Regulatory Support

We help governments establish a strong enabling environment for PPPs

- Development of PPP policies, strategies, and guidelines

- Review and drafting of PPP laws, regulations, and standard contracts

- Institutional framework design, including PPP units and Project Facilitation Funds.

- Capacity building for regulators and policymakers on PPP governance.

Through our PPP Policy, Legal, and Regulatory Support, we help governments and institutions:

- Build clear and transparent PPP frameworks that attract private investment

- Strengthen institutional capacity for effective PPP governance.

- Promote fiscal responsibility and long-term sustainability of PPP programs.

- Align PPP frameworks with climate, social, and sustainable development goals.

Feasibility Studies and Project Preparation

The success of any Public-Private Partnership (PPP) project depends on the quality of its preparation and feasibility assessment. Poorly prepared projects lead to delays, investor hesitation, cost overruns, or even outright failure. Well-prepared projects, on the other hand, attract credible investors, achieve financial close faster, and deliver value for money for governments and citizens.

At orion, we provide end-to-end PPP Feasibility and Project Preparation Advisory Services that ensure projects are technically sound, financially viable, socially inclusive, environmentally sustainable, and institutionally supported. We combine rigorous analysis with practical structuring to ensure that projects are ready for procurement and attractive to both public stakeholders and private investors.

Sub Services

- Technical Feasibility and Project Definition

We ensure projects are technically robust and aligned with demand

- Project scoping and definition of objectives

- Demand analysis and traffic/usage forecasting

- Technical options analysis and cost estimates

- Engineering, design and lifecycle performance assessments

- Identification of innovative and climate-smart design solutions

- Financial and Economic Feasibility

We conduct in-depth financial and economic analysis to establish viability and value for money.

- Cost-benefit analysis (CBA) and economic rate of return (ERR)

- Financial modeling, sensitivity, and scenario analysis

- Tariff/revenue model design and affordability assessments

- Fiscal impact, contingent liability, and budget sustainability analysis

- Value-for-Money (VfM) assessments comparing PPP to traditional procurement

- Legal, Policy, and Institutional Assessment

We align projects with enabling frameworks to ensure compliance and bankability

- Review of sector-specific and cross-cutting legal frameworks

- Assessment of PPP policy, regulations, and procurement rules

- Institutional readiness analysis and role definition

- Recommendations on approvals, permits, and compliance requirements

- Value-for-Money (VfM) assessments comparing PPP to traditional procurement

- Environmental and Social Safeguards

We integrate sustainability and inclusivity into project design

- Environmental and Social Impact Assessments (ESIA)

- Resettlement Action Plans (RAPs) and livelihood restoration programs.

- Climate change risk assessments and adaptation planning

- Gender, equity, and social inclusion (GESI) mainstreaming

- Alignment with international safeguard standards (IFC, World Bank, AfDB, etc)

- Risk Analysis and Allocation

We design robust risk frameworks that balance public and private sector interests

- Comprehensive risk identification and quantification

- Development of optimal risk allocation matrices.

- Mitigation measures for construction, demand, financial, and political risks

- Advisory on risk-sharing mechanisms (guarantees, insurance, VGF).

- Project Structuring and Bankability Assessment

We prepare projects for market readiness and private participation

- PPP option analysis and structuring (concession, BOT, BOOT, DBFOM, etc.).

- Bankability assessments and investor appetite analysis.

- Development of financial support mechanisms (blended finance, guarantees).

- Market sounding with potential investors, financiers, and operators.

- Recommendations on procurement strategy and next steps

- Procurement Preparation and Transaction Readiness

We ensure projects transition smoothly from preparation to procurement.

- Development of project information memoranda (PIMs) for investors.

- Drafting of pre-procurement documentation (RFQs, RFPs, draft contracts).

- Procurement timelines, process design, and evaluation criteria.

- Support in obtaining approvals from PPP committees and oversight bodies.

PPP Financial structuring and Investment Advisory

Mobilizing private investment for infrastructure through Public-Private Partnerships (PPPs) requires more than technical feasibility — it demands sound financial structuring, innovative investment solutions, and credible risk allocation. Governments face increasing pressure to deliver infrastructure within constrained budgets, while investors require projects that are bankable, transparent, and commercially viable.

At Orion, we provide PPP Financial Structuring and Investment Advisory Services that bridge the gap between public sector priorities and private sector requirements.

Our approach combines financial innovation, market insights, and risk management expertise to design structures that attract financing, achieve value for money, and ensure long-term project sustainability.

Sub Services

- Financial Modeling and Bankability Assessment

We design robust financial models to test project viability and investor attractiveness.

- Development of detailed project finance models

- Sensitivity analysis, stress testing, and scenario planning

- Tariff/revenue modeling and affordability assessments

- Bankability assessments and financial due diligence

- Capital Structuring and Financing Solutions

We advise on optimal financing structures that balance debt, equity, and public support.

- Structuring of debt-equity financing arrangements.

- Identification of funding gaps and financial support instruments

- Viability Gap Funding (VGF) and results-based financing mechanisms

- Blended finance solutions combining public, private and donor funding

- Risk Allocation and Credit Enhancement

We design frameworks to manage risks and improve investor confidence.

- Risk identification, quantification and allocation strategies.

- Credit enhancement instruments such as guarantees, insurance, and political risk cover.

- Development of contingent liability management strategies

- Design of government support packages to ensure bankability

- Investment Advisory and Market Engagement

We connect projects with the right investors, financiers, and strategic partners.

- Market sounding with potential lenders, investors, and operators.

- Investor outreach and preparation of investment promotion materials..

- Advisory on PPP deal marketing and negotiation strategies

- Support in engaging development finance institutions (DFIs), multilateral banks and private financiers.

- Green and Sustainable Finance Solutions

We embed sustainability into financial structures to align with global climate goals.

- Structuring of green bonds, infrastructure bonds, and sustainability-linked loans..

- Advisory on carbon markets and climate finance instruments..

- Integration of ESG (Environmental, Social, Governance) principles into financing.

- Access to global climate funds and impact investment markets.

- Transaction Support and Financial Close Advisory

We guide projects through the critical steps to reach financial closure.

- Assistance in drafting financial sections of tender documents..

- Evaluation of financial bids and negotiation support..

- Advisory during lender due diligence and syndication processes..

- Support in closing financial agreements with lenders and investors..

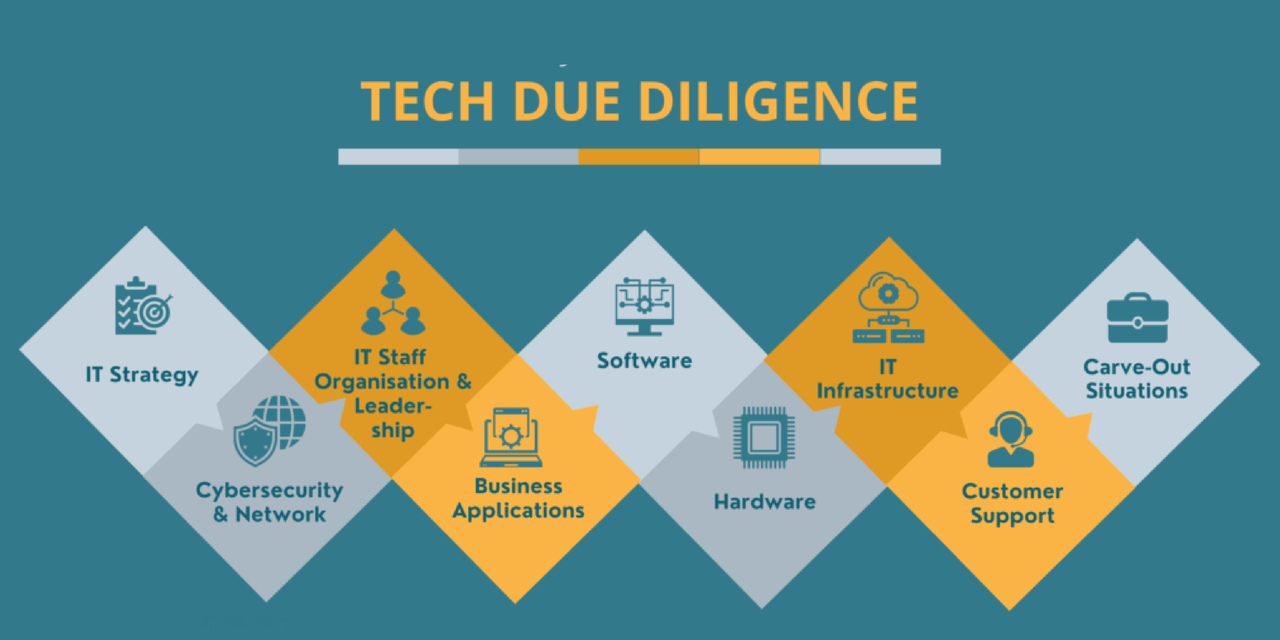

Due Diligence

At Orion, we provide comprehensive PPP Due Diligence Advisory Services across legal, financial, technical, environmental, and social dimensions. Our multidisciplinary approach helps governments, lenders, and private investors validate assumptions, uncover risks, and strengthen the integrity of PPP projects before financial close or contractual commitments.

Sub Services

- Legal and Regulatory Due Diligence

We assess the legal environment to ensure compliance, enforceability, and contractual clarity.

- Review of PPP laws, regulations, and procurement compliance

- Evaluation of concession agreements, risk allocation, and termination clauses

- Assessment of permits, licenses, and approvals

- Analysis of dispute resolution mechanisms and investor protections.

- Financial and Commercial Due Diligence

We validate financial models and commercial assumptions to ensure project viability.

- Review of financial models, assumptions, and sensitivity analysis.

- Validation of revenue forecasts, tariff structures, and demand estimates.

- Assessment of funding sources, debt-equity structure, and fiscal impacts.

- Evaluation of contingent liabilities and government support obligations

- Technical Due Diligence

We examine technical designs and assumptions to ensure deliverability and efficiency.

- Review of engineering designs, technical standards, and specifications.

- Assessment of construction schedules, cost estimates, and lifecycle planning.

- Evaluation of operations and maintenance (O&M) strategies.

- Identification of technical risks and mitigation strategies

- Environmental and Social Due Diligence

We ensure compliance with safeguards and sustainability standards.

- Review of Environmental and Social Impact Assessments (ESIAs).

- Compliance with international safeguard frameworks (IFC, World Bank, AfDB, etc.).

- Evaluation of resettlement, land acquisition, and stakeholder engagement plans.

- Analysis of climate resilience, ESG risks, and social inclusion measures.

- Institutional and Governance Due Diligence

We assess the capacity and governance systems of key stakeholders

- Review of institutional readiness and governance frameworks

- Assessment of PPP units, regulators, and contracting authorities.

- Evaluation of contract management and oversight mechanisms.

- Recommendations on capacity gaps and institutional strengthening.

- Lender and Investor Due Diligence

We provide assurance to financiers and investors on project integrity and risk.

- Independent review of bankability and financial close readiness.

- Validation of risk allocation and credit enhancement mechanisms

- Support during negotiations with lenders, DFIs, and equity investors

- Advisory on compliance with ESG investment standards.

Negotiation and Transaction Support

Negotiation is at the heart of every Public-Private Partnership (PPP). Successful PPP transactions require balanced agreements that safeguard public interests, satisfy investor requirements, and allocate risks fairly. Poorly negotiated contracts often lead to disputes, renegotiations, or failed projects. Strong negotiation and transaction support ensures that PPPs achieve financial close efficiently and set the stage for long-term success.

At Orion, we provide specialized PPP Negotiation and Transaction Support Services that guide governments, contracting authorities and private sector partners through the entire transaction process. Our multidisciplinary team combines financial, legal, technical, and commercial expertise to ensure transparent, fair, and bankable outcomes.

Sub Services

- Transaction Structuring and Strategy

We design strategies that position PPP projects for successful transactions.

- Development of transaction roadmaps and timelines

- Structuring of procurement approaches (competitive bidding, direct negotiation, hybrid).

- Definition of evaluation criteria and bid processes

- Market sounding to align transaction strategy with investor appetite

- Procurement and Bidding Support

We guide governments and contracting authorities through transparent, compliant procurement.

- Preparation of procurement documentation (EOIs, RFQs, RFPs, draft contracts)

- Bidder prequalification and evaluation frameworks

- Bid evaluation support and advisory to evaluation committees

- Ensuring compliance with PPP laws, procurement regulations, and international best practices.

- Negotiation Advisory

We support governments and private sector clients in reaching balanced agreements.

- Advisory on risk allocation, payment mechanisms, and performance standards.

- Development of negotiation strategies and fallback positions.

- Support in financial, legal, and technical negotiations.

- Facilitating consensus among multiple stakeholders.

- Ensuring alignment with fiscal sustainability and value-for-money principles.

- Contract Finalization and Documentation

We help finalize agreements that are enforceable, balanced, and sustainable.

- Drafting and review of concession agreements, shareholder agreements, and ancillary contracts.

- Advisory on key clauses — termination, force majeure, step-in rights, and dispute resolution.

- Ensuring contracts reflect negotiated terms and risk-sharing arrangements.

- Support in drafting schedules, annexes, and performance guarantees.

- Financial Close Support

We guide projects through the critical step of securing financing.

- Coordination with lenders, investors, and DFIs during due diligence.

- Advisory on financial agreements, security packages, and syndication.

- Support in meeting conditions precedent to financial close.

- Ensuring alignment between project agreements and financing documents.

- Dispute Prevention and Renegotiation Support

We strengthen long-term contract resilience through proactive advisory.

- Advisory on dispute resolution mechanisms and arbitration strategies.

- Support in addressing investor concerns during renegotiation.

- Independent facilitation in complex government–private sector negotiations

- Development of contract management protocols to reduce disputes.

PPP Contract Management and Post-Award Support

Signing a PPP contract is only the beginning. The true test of a PPP project lies in implementation, performance, and long-term management. Effective contract management and post-award support ensure that commitments made during procurement translate into real outcomes: quality services, value for money, and fiscal sustainability.

Without proper oversight, PPPs risk cost overruns, service failures, and disputes that can undermine both public and private interests.

At Orion, we provide PPP Contract Management and Post-Award Support Services that strengthen government oversight capacity, protect public interests, and ensure that private partners deliver on their obligations throughout the project lifecycle.

Sub Services

- Contract Handover and Mobilization Support

We support smooth transition from transaction close to implementation.

- Preparation of contract management handover reports.

- Briefings and capacity building for contract management teams.

- Establishing project monitoring frameworks, KPIs, and reporting systems

- Advisory on conditions precedent to construction or service commencement.

- Performance Monitoring and Compliance

We ensure that service delivery aligns with agreed performance standards

- Development of performance monitoring tools and dashboards.

- Review of Key Performance Indicators (KPIs) and service-level agreements (SLAs).

- Monitoring compliance with payment mechanisms, risk allocation, and obligations.

- Independent verification of service outputs and quality

- Financial and Fiscal Oversight

We track financial performance to protect government budgets and ensure sustainability.

- Review of payment calculations under availability- or demand-based models.

- Monitoring of revenue-sharing arrangements and tariff adjustments

- Fiscal impact assessments of contingent liabilities and government support.

- Oversight of refinancing and restructuring arrangements.

- Risk Management and Renegotiation Support

We help manage evolving risks and maintain contract resilience.

- Identification of emerging risks during construction and operation.

- Advisory on contract amendments, variations, and renegotiations.

- Development of risk mitigation and contingency plans.

- Guidance on rebalancing arrangements due to force majeure or economic shifts.

- Dispute Prevention and Resolution

We minimize disputes and facilitate constructive engagement.

- Advisory on dispute avoidance mechanisms and early warning systems

- Support in managing claims, delays, or performance failures.

- Advisory on mediation, arbitration, and structured negotiation processes

- Independent facilitation between contracting authorities and private partners.