At Orion, we specialize in comprehensive project development services that cover every phase from inception to completion. Our expertise includes Strategic Project Advisory, Feasibility and Business Case Development, Transaction Structuring, and PPP Design. We also provide Financial and Investment Advisory, Procurement and Transaction Execution, alongside robust Risk Management and Legal Interface. Additionally, we offer Post-Transaction Support to ensure sustained project success.

Strategic Project Advisory

Orion begins by supporting governments or private developers with upstream project development activities to ensure bankability, viability, and alignment with policy goals.

Sub Services

- National Infrastructure Planning Support

Orion Infrastructure Africa assists governments in developing national infrastructure strategies by providing expertise in planning and aligning infrastructure projects with broader economic and social goals.

This service ensures that national infrastructure plans are comprehensive, sustainable, and meet the needs of both the current and future population.

Orion works to prioritize projects based on their economic, social, and environmental impact. We also assist in creating actionable roadmaps for infrastructure development.

- Sector Diagnostics

Orion conducts in-depth diagnostics to evaluate the current state of various sectors, including transport & Connectivity, energy & Climate resilient, and Urban & Social infrastructure.

Our team analyzes sector performance, identifies key challenges, and assesses the potential for improvement or expansion.

This diagnostic approach helps determine investment opportunities, ensures sectors align with broader development objectives and highlights the most pressing needs in these critical infrastructure areas.

- Demand and gap analysis

Orion performs detailed demand and gap analysis to identify discrepancies between existing infrastructure capacity and projected future needs.

This service helps in understanding the demand for infrastructure in key sectors and enables clients to make informed decisions regarding where to invest.

Our analysis ensures that infrastructure projects are designed to meet the needs of growing populations, businesses, and industries while addressing any service delivery gaps.

- Development of project pipelines

Orion supports the creation of a robust pipeline of infrastructure projects, ensuring a steady flow of viable and strategic projects for governments or private developers.

Our service includes identifying priority projects, developing project concept note, conducting pre-feasibility studies, and creating structured plans for implementation.

By developing a comprehensive project pipeline, we help ensure that investments are made in areas that will drive long-term growth and meet public demand.

- Legal and regulatory framework assessment

Orion evaluates the legal and regulatory environments governing infrastructure projects to ensure that they support successful implementation and sustainability.

We analyze existing policies, laws, and regulations to identify potential barriers to project execution and propose solutions for improvement.

This service ensures that all infrastructure projects comply with relevant legal frameworks and are structured to minimize risks related to legal and regulatory challenges.

- Project identification, Screening and Prioritization

Orion's project identification, screening, and prioritization services help governments private investors, and developers assess the feasibility and importance of various infrastructure projects.

We use detailed criteria, including economic impact, sustainability, bankability, commercial viability, and alignment with national goals, to screen and rank projects.

This process ensures that resources are allocated to the most impactful and viable projects, optimizing both short-term and long-term benefits for stakeholders.

Feasibility and Business Case Development

Before a major infrastructure project can begin, it must be thoroughly vetted and proven viable from every angle. At Orion Infrastructure Africa, our Feasibility and Business Case Development services provide the deep, feasibilty analysis required to transform a concept into a robust, investment-ready project. We move beyond initial ideas to build a comprehensive case that examines a project's technical, financial, economic, legal, and environmental dimensions. This holistic approach ensures that every project we support is not only practical and profitable but also sustainable and beneficial for the communities it serves.

Sub Services

- Technical feasibility studies

Orion conducts comprehensive technical feasibility studies to assess the practicality and viability of infrastructure projects.

This involves evaluating the technical requirements, potential challenges, and available resources for project execution.

Our team ensures that the proposed project can be implemented successfully within the specified technical constraints, addressing any engineering or design challenges that may arise during construction and operation.

- Social and Environmental Impact Assessments (SEIA/EIA)

Orion performs detailed Social and Environmental Impact Assessments (SEIA/EIA) to evaluate how a project may affect local communities and the surrounding environment.

We identify potential negative impacts, propose mitigation measures, and ensure that projects align with local and international environmental standards.

Our assessments help ensure that infrastructure projects contribute positively to sustainable development while minimizing harmful effects on ecosystems and society.

- Financial Feasibility and Modeling

Orion provides financial feasibility studies and detailed modeling to assess the economic viability of infrastructure projects.

We analyze costs, revenue potential, and funding options, ensuring that the project is financially sustainable and attractive to investors.

Our financial models help stakeholders understand key metrics like return on investment (ROI), payback periods, and financing structures, facilitating informed decision-making for project implementation.

- Economic Analysis (e.g., Cost-Benefit Analysis)

Orion conducts rigorous economic analysis, including cost-benefit analysis, to assess the broader economic impact of a project.

This includes evaluating the project’s potential to generate value, create jobs, improve productivity, and contribute to overall economic growth.

Our analysis helps determine whether the project's benefits outweigh the costs, providing decision-makers with critical information to justify investment and ensure long-term economic sustainability.

- Legal and Institutional Readiness Reviews

Orion assesses the legal and institutional frameworks necessary for the successful implementation of infrastructure projects.

We review the readiness of laws, regulations, and institutional arrangements, identifying any gaps that may hinder project progress.

This service ensures that legal and institutional frameworks are well-prepared to support project development, minimizing risks and ensuring compliance with relevant regulations.

- Preparation of Full Business Case (FBC) / Detailed Project Reports (DPRs)

Orion supports the preparation of a Full Business Case (FBC) or Detailed Project Reports (DPRs), providing a comprehensive evaluation of the project from multiple perspectives.

This includes technical, financial, legal, and environmental considerations, presenting a clear justification for investment.

The FBC/DPR is a critical document that outlines the project's scope, risks, benefits, and implementation strategies, providing stakeholders with the information necessary to proceed to the next phase of development.

Transaction Structuring and PPP Design

Orion specializes in designing robust transaction structures for project finance and Public-Private Partnership (PPP) infrastructure projects. We apply value-for-money principles and create effective risk allocation matrices to ensure project success. Our services include comprehensive PPP options analysis, commercial due diligence, and viability gap financing mechanisms. We also identify potential revenue streams and optimal payment models like user fees or availability payments.

Sub Services

- Project structuring and risk allocation matrix

We specialize in designing robust project structures and comprehensive risk allocation matrices.

This crucial step ensures a fair and balanced distribution of risks between public and private partners.

By identifying, assessing and allocating project risks, we minimize potential disputes and maximize efficiency throughout the project lifecycle, laying a stable and transparent foundation for its long-term success.

- PPP options analysis

Our team conducts a detailed analysis of various Public-Private Partnership (PPP) models, such as Design-Build-Finance-Operate-Maintain (DBFOM), Build-Operate-Transfer (BOT), and Build-Own-Operate-Transfer (BOOT) etc.

We determine the most suitable option for a specific project based on its unique requirements, strategic objectives, and financial goals.

This rigorous process ensures the selected model aligns perfectly with project needs and maximizes stakeholder value.

- Value-for-money assessment (VfM)

We perform a rigorous value-for-money (VfM) assessment to evaluate whether a PPP approach is more cost-effective and beneficial than traditional public procurement.

This analysis compares both quantitative and qualitative aspects of the options, ensuring optimal resource utilization and enhanced public benefit.

Our assessment provides a clear, data-driven justification for the chosen project delivery method, building confidence in the investment.

- Commercial due diligence

Our team provides thorough commercial due diligence to assess a project's commercial viability and financial sustainability.

We analyze key factors such as market demand, revenue projections, and the competitive landscape to identify potential risks and opportunities.

This comprehensive process mitigates uncertainties, builds investor confidence, and informs critical investment decisions, ensuring the project's long-term success and profitability.

- Design of Viability Gap Financing (VGF)

We design and implement viability gap financing (VGF) mechanisms to bridge the funding gap for projects that are socially and economically essential but not commercially viable.

By creating a framework for strategic government support, we make these critical projects attractive to private investors.

This ensures the successful execution of vital infrastructure that serves a broader public good.

- Potential Revenue Streams and Payment Models

We identify and analyze potential revenue streams and design optimal payment models, such as availability payments or user fees.

This ensures a sustainable financial structure for the project and provides clarity on how the private partner will be compensated.

Our work secures a steady and reliable income for the project, benefiting all parties involved and ensuring financial predictability.

Financial and Investment Advisory

Orion offers expert Financial and Investment Advisory to bridge the gap between public ambition and private sector expectations for infrastructure projects. Working with financial institutions, we provide critical investment readiness and capital mobilization support. Our team helps clients navigate complex financial landscapes to secure the necessary funding, ensuring project viability and attracting the right investors for long-term success.

Sub Services

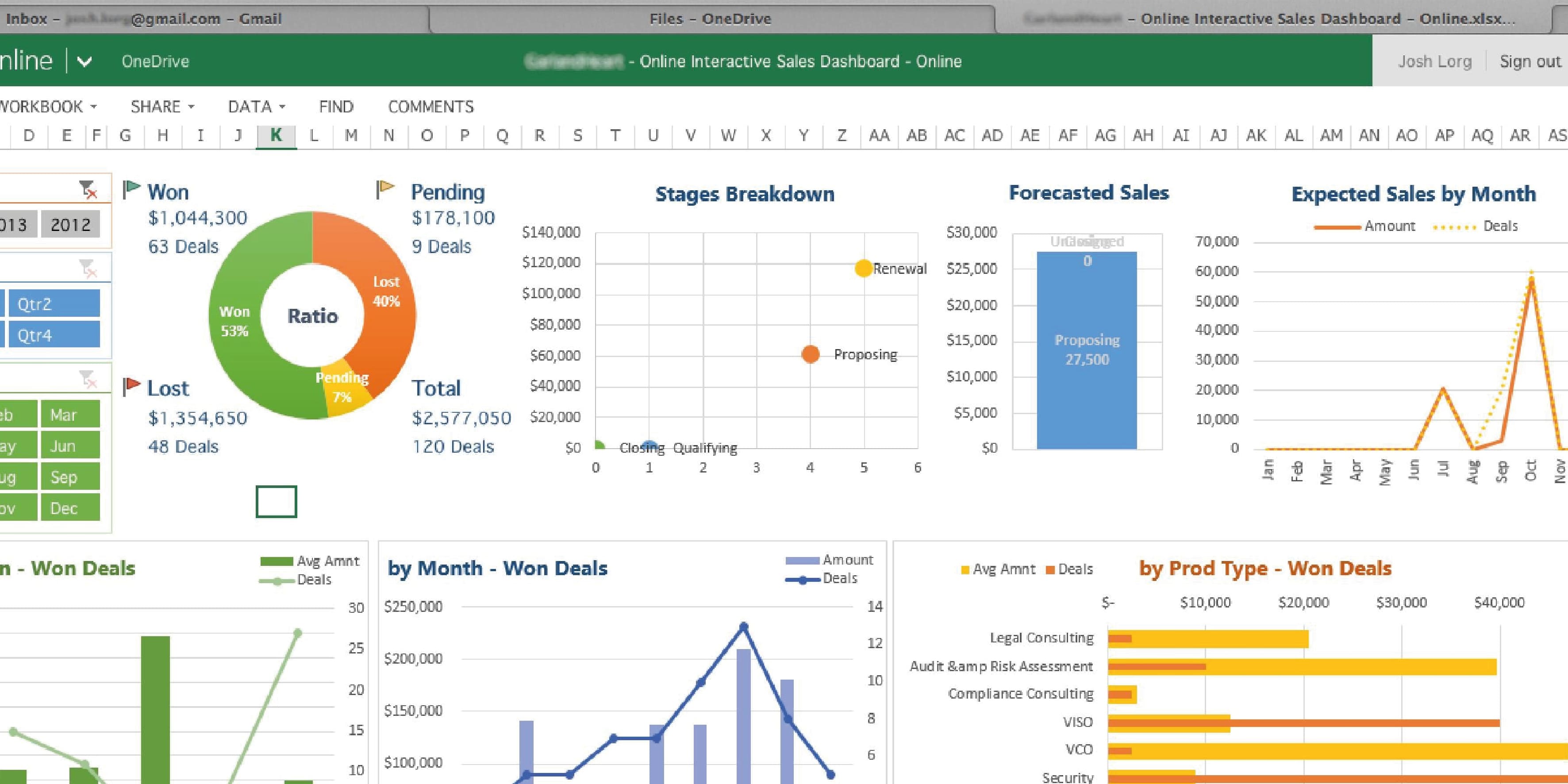

- Project Financial Modeling

We specialize in developing robust project financial models using Excel-based and scenario-based tools.

Our models are crucial for accurately forecasting cash flows, assessing financial viability, and evaluating potential returns for investors.

By simulating various market conditions, we help clients understand and effectively manage financial risks, ensuring their projects are both resilient and attractive to funders.

- Capital Structuring and Sources of Funds Analysis

Our team excels at capital structuring, identifying the most efficient combination of debt and equity for your project.

We conduct a detailed analysis of all available funding sources, from commercial banks to development finance institutions, to create a capital stack that minimizes costs and maximizes returns.

This ensures a strong financial foundation, attracting the right blend of capital for project success.

- Assessment of Financial Instruments

We assess a wide range of financial instruments, including equity, debt, guarantees, and blended finance.

Our analysis helps determine the optimal combination to meet your project's unique financial needs.

We guide you in leveraging these tools to attract investment, mitigate risks, and secure the necessary capital for project implementation and long-term sustainability, ensuring financial security.

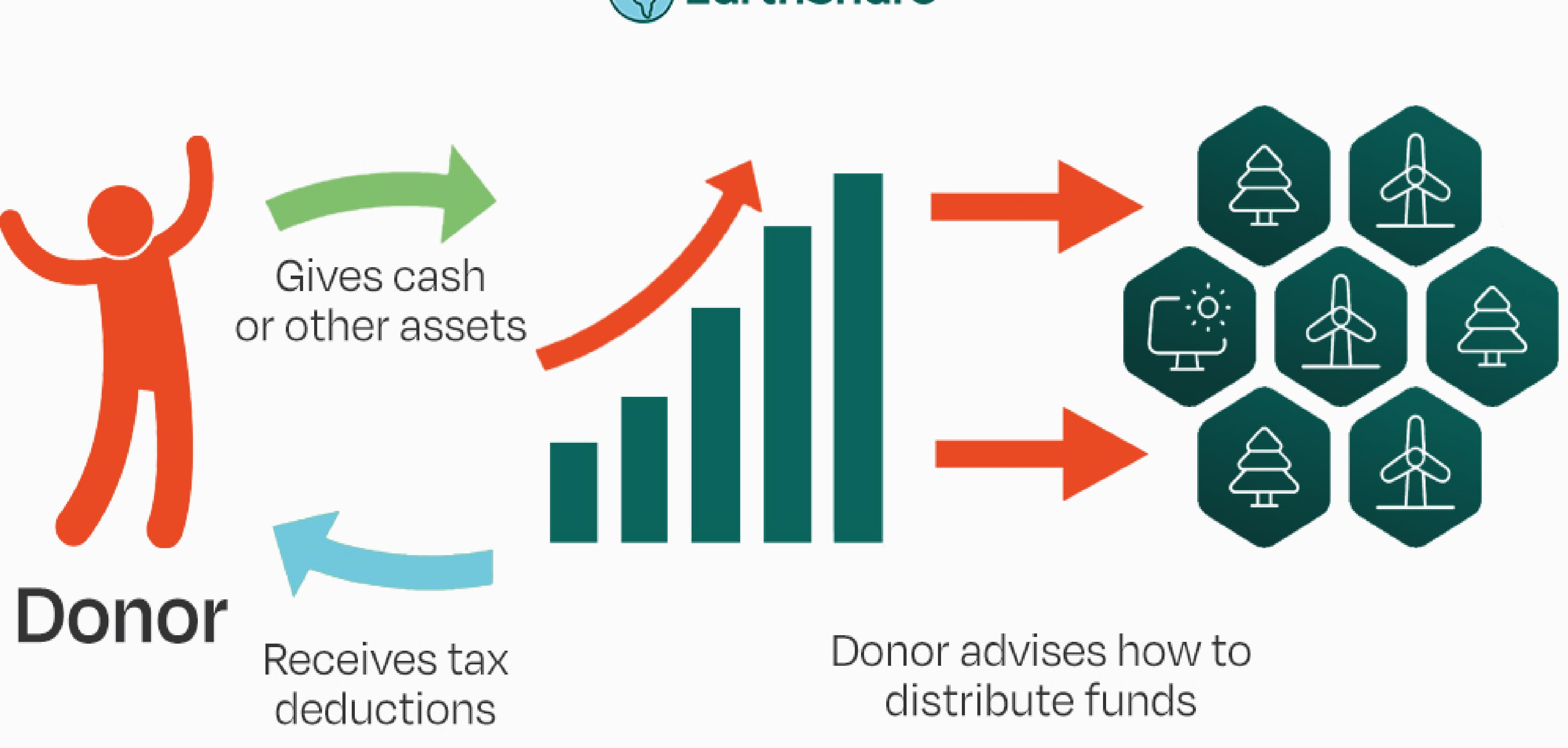

- Advice on Donor/Grant Integration

We provide expert advice on integrating support from major donors and grant providers, such as the World Bank, AfDB, and PIDG.

Our guidance helps you navigate the complex requirements for accessing these critical funds, which can bridge financing gaps and significantly improve project viability.

We ensure your project's financial structure is optimized to attract this crucial support.

- Market Sounding and Investor Engagement

Our firm conducts targeted market sounding and investor engagement to gauge private sector interest in your project.

We connect with potential investors, lenders, and development partners to gather feedback on project structure and financial terms.

This process refines the offering, ensuring it aligns with market expectations and substantially increases the likelihood of a successful financial close.

- Tariff and Pricing Strategy

We develop comprehensive tariff and pricing strategies that balance affordability for users with financial viability for the project.

Our analysis considers market demand, operational costs, and regulatory frameworks to create a sustainable pricing model.

This ensures a reliable revenue stream for the private partner while providing essential public services at fair and justifiable rates.

Procurement and Transaction Execution

Orion provides end-to-end Procurement and Transaction Execution services, ensuring your project meets global best practices and local regulations. Our core offering manages the entire process from strategy to financial close, ensuring compliance with national PPP laws and donor procedures. We guide clients through every step, minimizing risks and delivering a seamless transaction that achieves a successful outcome.

Sub Services

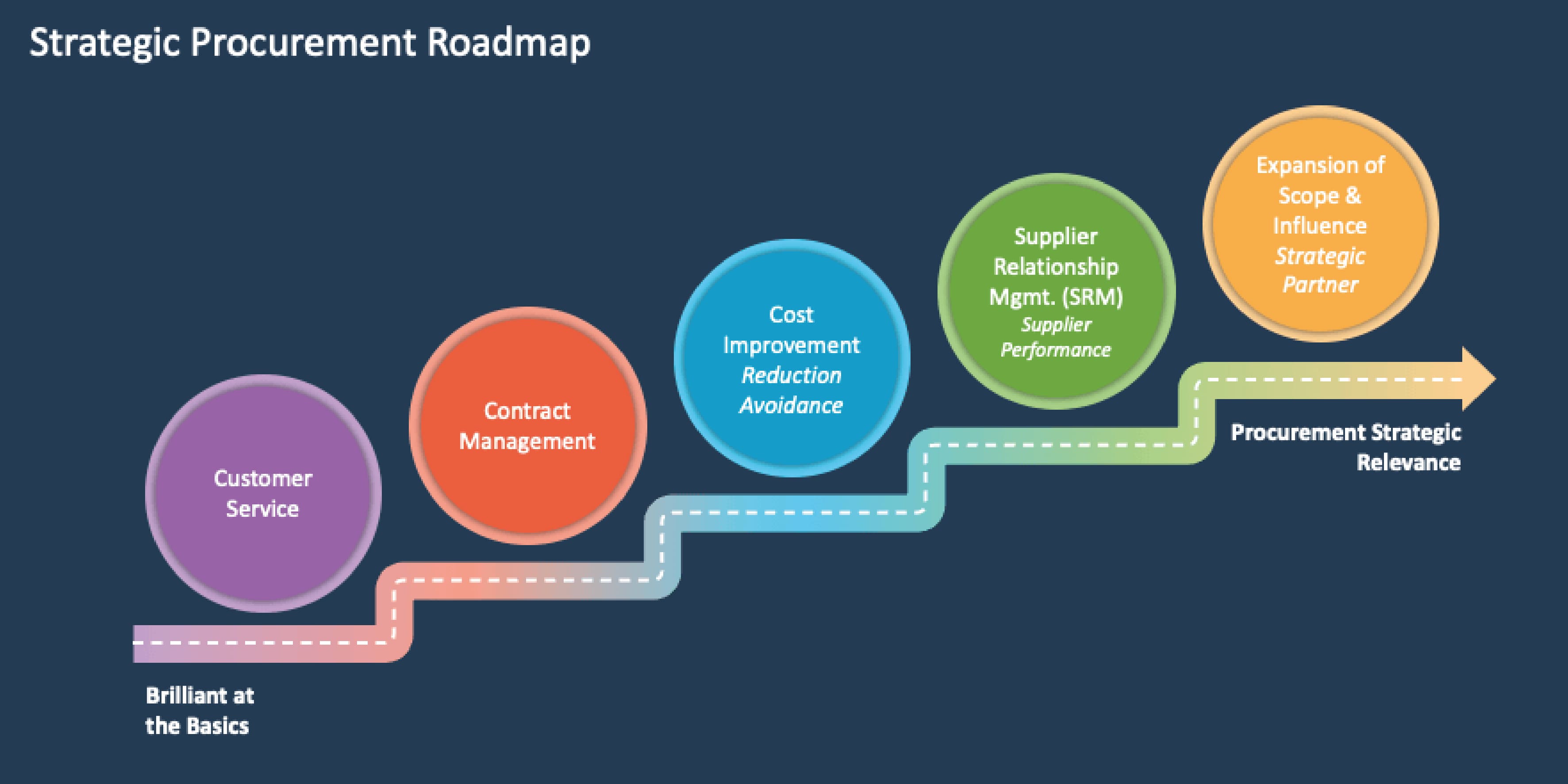

- Procurement Strategy and Roadmap

We develop a detailed procurement strategy and roadmap that outlines the entire transaction process.

Our plan identifies key milestones, timelines, and legal requirements, ensuring a clear and efficient path to project success.

This strategic approach minimizes delays and mitigates risks, providing a transparent framework that guides all stakeholders from initial concept to financial close.

- Preparation of Procurement Documents

We prepare all necessary procurement documents, including Requests for Qualification (RFQ) and Requests for Proposal (RFP).

Our team also drafts comprehensive concession agreements and term sheets.

These documents are designed to be clear, legally sound, and compliant with all relevant regulations, attracting qualified bidders and ensuring a fair and transparent process.

- Bid Process Management

Our team provides full bid process management, overseeing all aspects from the initial public advertisement to the final submission.

We manage communications with bidders, handle clarifications, and ensure strict adherence to all procedural rules.

This structured approach maintains the integrity of the process, fostering a competitive environment and building confidence among all participants.

- Bid Evaluation and Compliance Assessments

We conduct rigorous bid evaluation and compliance assessments to identify the most suitable private sector partner.

Our team evaluates technical proposals, financial submissions, and legal compliance against pre-defined criteria.

This objective assessment ensures the selection of a bidder who offers the best value for money and has the proven capacity to successfully deliver the project.

- Support in Negotiation and Contract Award

We provide expert support during negotiation and contract award, helping clients finalize the concession agreement.

Our team works to secure favorable terms, resolve outstanding issues, and ensure all contractual details are legally sound.

We guide you through the final stages of the transaction, leading to a successful contract signing and a solid foundation for the project.

- Financial Close Advisory

We offer dedicated financial close advisory to guide projects through the final close phase.

Our services include coordinating with all parties, satisfying all conditions precedent, and resolving any last-minute issues.

We ensure all legal and financial requirements are met, leading to the successful disbursement of funds and the official start of project implementation.

Risk Management and Legal Interface

Orion’s Risk Management and Legal Interface services are a core part of our multidisciplinary approach. Our legal advisors ensure that project contracts adequately distribute risks and protect both public and private interests. This collaborative method ensures that all legal and financial risks are identified, managed, and allocated appropriately, safeguarding the project's long-term success.

Sub Services

- Risk Identification and Quantification

We specialize in risk identification and quantification, creating detailed risk registers that list and assess all potential project risks.

Our process involves systematically identifying technical, financial, and legal risks, and then quantifying their potential impact and likelihood.

This foundational step provides a clear overview of all vulnerabilities, enabling a proactive approach to project management.

- Risk Allocation Matrix and Mitigation

We develop a comprehensive risk allocation matrix and detailed mitigation strategies.

Our matrix ensures that each risk is assigned to the party best equipped to manage it, whether public or private.

We also create practical strategies to mitigate these risks, minimizing their potential impact and ensuring project continuity. This structured approach provides a clear framework for managing uncertainty.

- Interface with Legal Counsel on PPP Agreements

We serve as the key interface with legal counsel throughout the drafting of PPP agreements.

Our role is to ensure that all commercial and technical aspects of the project are accurately reflected in the legal documents.

We work to translate project complexities into legally sound terms, ensuring the final contract is robust, fair, and protective of our client's interests.

- Contingent Liability and Fiscal Impact Analysis

We perform thorough contingent liability and fiscal impact analysis to assess the potential financial burden on the government.

Our work identifies hidden risks and calculates the potential cost of various scenarios, such as project failure or unexpected events.

This analysis is critical for ensuring fiscal responsibility and providing a complete picture of the project's long-term financial implications.

- Insurance Structuring Support

We offer expert insurance structuring support to protect against a wide range of project risks.

We advise on the types and levels of insurance coverage required, helping to design a robust insurance program that minimizes financial exposure for all parties.

Our support ensures that appropriate safeguards are in place, providing financial security against unforeseen events and operational disruptions.

Post-Transaction Support

Orion provides essential post-transaction support to ensure the successful delivery and ongoing compliance with your infrastructure projects. Our services extend beyond financial close, helping clients manage construction, assess operational readiness, and ensure contract adherence. We act as a trusted partner, safeguarding the project's long-term success and protecting the interests of all stakeholders throughout its lifecycle.

Sub Services

- Construction Monitoring

We provide comprehensive construction monitoring to ensure the project is built according to the agreed-upon specifications and timeline.

Our team conducts regular site visits and progress reviews, identifying potential issues early to prevent delays and cost overruns.

This proactive oversight ensures that the construction phase meets all contractual obligations and quality standards.

- Operational Readiness Assessments

We conduct detailed operational readiness assessments to ensure a smooth transition from the construction phase to commercial operations.

Our review covers key areas such as staffing, maintenance plans, and operational procedures.

This process identifies and addresses any gaps, guaranteeing that the project is fully prepared to deliver high-quality, reliable services from day one.

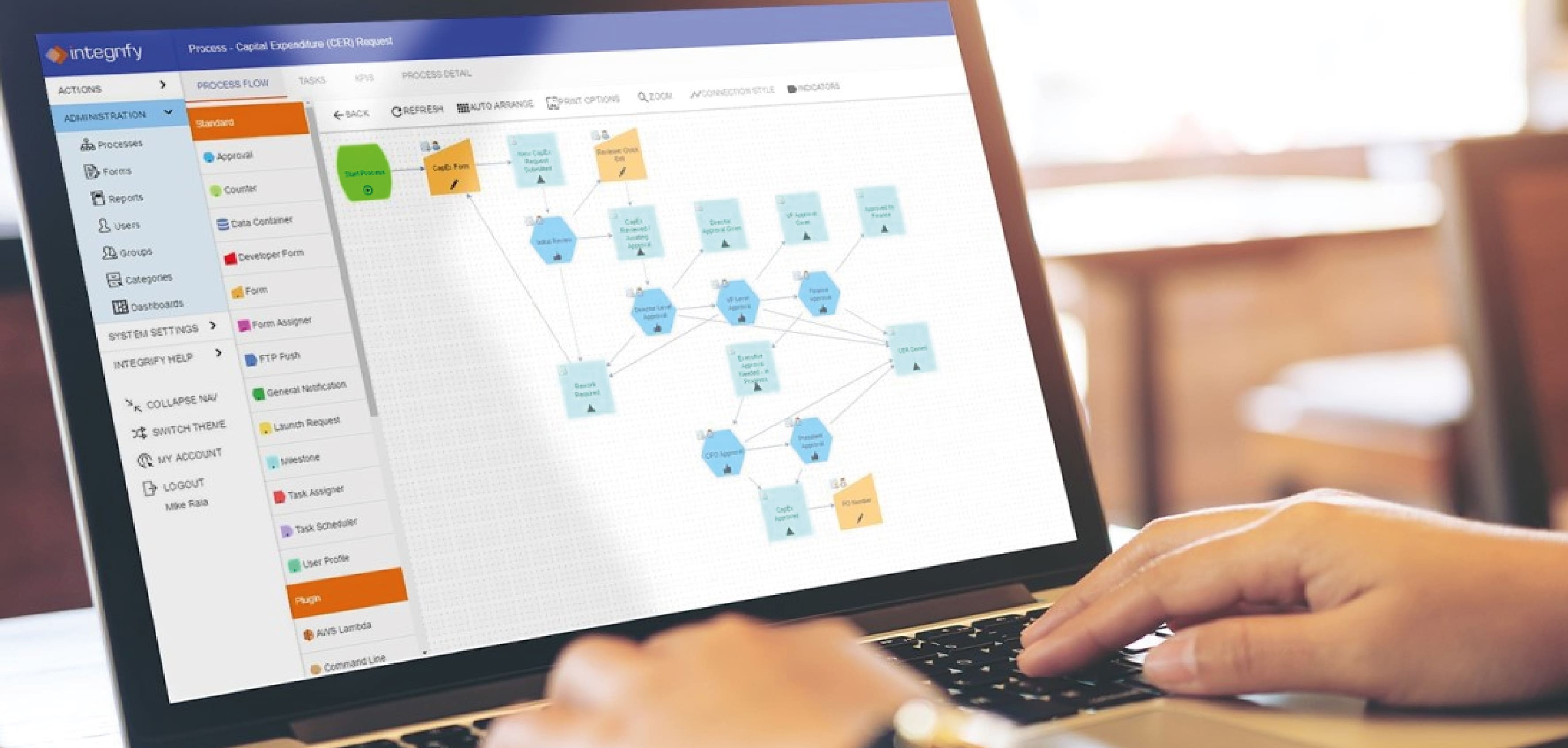

- Contract Management Support

We offer expert contract management support to ensure all parties adhere to the terms of the concession agreement.

Our team helps resolve disputes, manages change orders, and monitors performance to prevent non-compliance.

This ongoing support is crucial for maintaining a healthy working relationship between public and private partners and safeguarding the project's long-term viability.

- Performance Auditing

We specialize in performance auditing, particularly for availability-based PPPs.

Our team independently verifies that the private partner is meeting all contractual performance metrics, such as service availability and quality standards.

This objective assessment ensures the public receives the agreed-upon value, providing a transparent and accountable framework for project performance.

- Handback Condition Assessment

For long-term concessions, we perform a thorough handback condition assessment.

Our work evaluates the project's physical condition at the end of the concession term to ensure it meets the contractual requirements for transfer back to the public authority.

This crucial step protects the public's asset and ensures a smooth and orderly transition at the end of the contract.